- 20. January 2023

The rediscovered domesticity

On consumption in uncertain times and new shopper needs

Quo vadis, consumer? Everyday life is coming to a standstill, but the adaptable consumer can also see the good side of this. Quality of life in lockdown times means more enjoyment and comfort.

Preferably regional, sustainable and in the neighborhood. Try coziness. 2020 has been a year of great social and economic change because of the Corona crisis. This development has also been reflected in food and grocery shopping. Due to the temporary closure or restrictions of restaurants, cafés, canteens and working from home, out-of-home consumption has fallen sharply. Food retailing (LEH) benefited significantly from this. For example, food retail sales, i.e., purchases of fast-moving consumer goods (FMCG), increased by 11.3 percent excluding specialist retailers and by as much as 12.3 percent including specialist retailers. This is driven by the fact that out-of-home consumption has been replaced by in-home consumption, and consumers wanted to do well at home. If they already had to spend a large part of their time at home due to the lockdown, they at least wanted to treat themselves to high-quality, healthy food.

Strong crisis profiteers

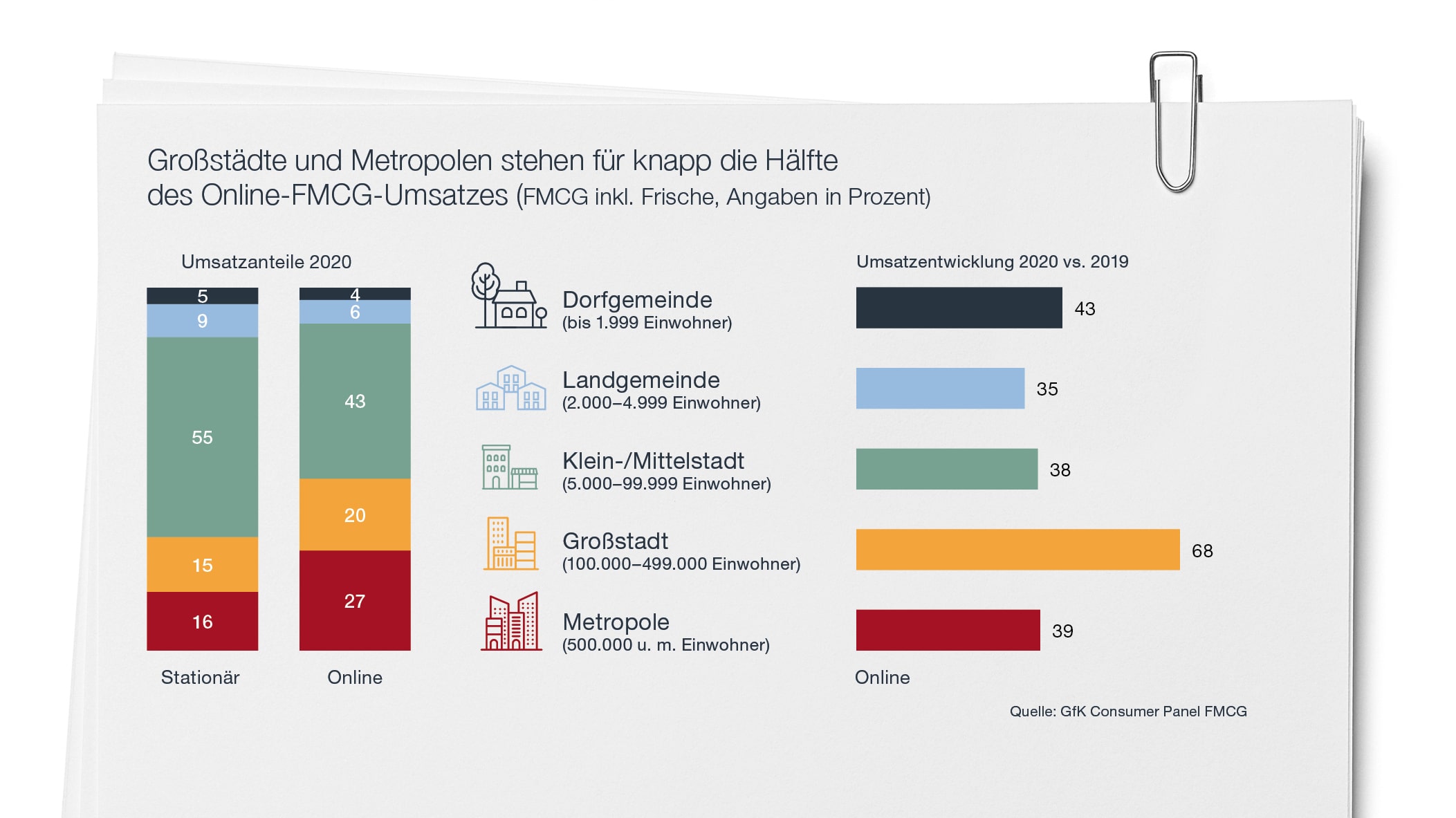

The various sales channels in the food retail sector benefited from the crisis in very different ways. In the FMCG sector, e-commerce (43 percent), full-range food retailers (17 percent) and specialist retailers (15 percent) achieved year-on-year growth, whereas discount stores and hypermarkets "only" grew by nine percent and ten percent respectively. When considering the sales growth of sales channels in Germany, a look at their market share distribution is very revealing. To the same extent as the discounters are losing market share, the full-range food retailers are gaining market share.

True leaps in growth

While many non-food sectors have seen e-commerce market share skyrocket due to the lockdown and store closures, FMCG e-commerce has been able to increase its market share despite a historic surge in brick-and-mortar FMCG retail sales. Corona has significantly moved the online sales channel forward and demand has grown significantly across all demographics, from young to old.

A look at the sizes of municipalities shows that FMCG e-commerce naturally has its focus in large cities. While in 2020 brick-and-mortar retail made 31 percent of its total sales in large cities with more than 100,000 inhabitants, FMCG e-commerce made 47 percent of its sales. This is not too surprising, because the offerings are primarily geared toward major cities. That's why it's also interesting to look at the municipalities. Online sales in the smaller communities, for example, also made a significant leap.

The good is so close

This also had to do with the product range of the specialist stores and possibly, for example, the artisanal way in which the products were manufactured. And last but not least, it had to do with the fact that certain trends in consumer behavior have intensified in the wake of the pandemic: Quality awareness, regionality, sustainability and freshness orientation. Fresh food retailers have consistently grown at an above-average rate during the pandemic. Organic retailers and regional producers in particular enjoyed consumer confidence.

Because the good things are so close at hand: Even before Corona, the younger generations in particular were increasingly turning to the region. They are looking for and finding their personal anchor in the local communities. The term that has been in use for some time now is "glocal citizenship. This includes family, friends, neighbors, colleagues - and also the local merchant.

Comfortable and tends to casual fashion

However, there was also positive momentum in the run-up to Christmas. For example, the top product groups this year included an exceptionally large number of kitchen equipment items such as woks, food processors and small electrical appliances. Households spent a quarter more on these items in the three weeks leading up to Christmas 2020 than in the same period last year. Even more than usual, these purchases were made online.

At home (it) tastes better

The food service industry was hit similarly dramatically as the stationary retail sector in 2020. Apart from the summer months, when infections were low and incidence levels were low, out-of-home consumption has been almost exclusively walking and standing.

A survey of shoppers in the GfK Consumer Panel in August and October 2020 shows that cooking at home has increased significantly compared to the pre-pandemic period. One-fifth of respondents said they now cook or prepare food at home more often instead of eating out. At the same time, health awareness has increased and around one-fifth of people say they want to eat more consciously more often in order to stay fit and healthy or to strengthen their immune system.

To sum up: first Corona, then Cocooning. What was out for a long time - home sweet home - is back in. Consumers are treading new paths, some of which are familiar. The future sometimes lies in the past.

By Thomas Steiner, GfK