- 22. February 2022

Boom meets boom

Why the risk perception of urban retail parks will change

Rare on the market, good and expensive. Retail parks are sought-after by investors. To keep it that way, they must remain open to change. The trend toward free home delivery through online services is growing. Local suppliers must react.

The future of urban retail parks lies in an intelligent mix of uses, and space is being redistributed. It is possible that even competition will still find a place under the center roof when the e-milk is flowing in streams.

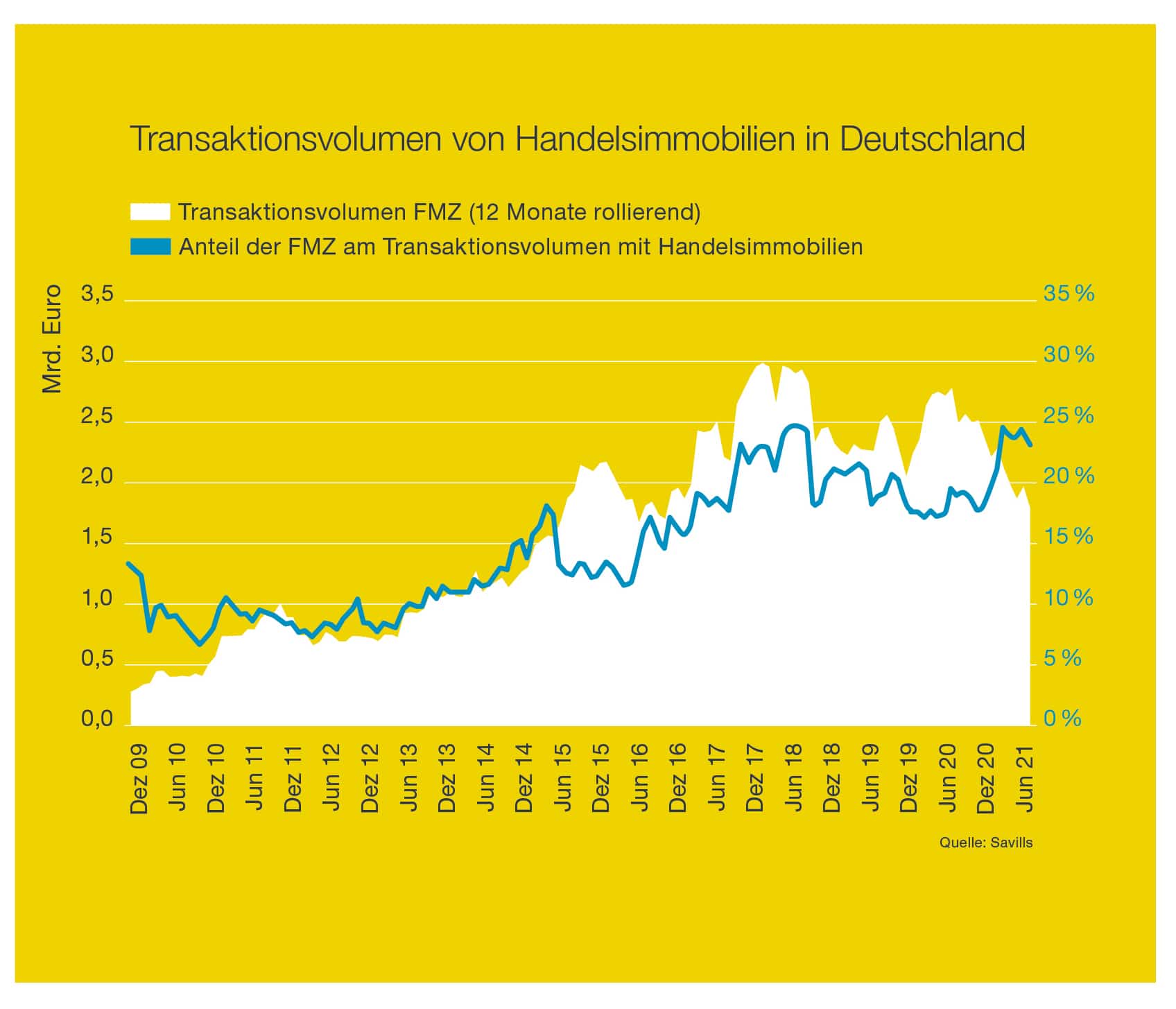

For years, retail parks have been the favorite child of investors, and this has not changed in 2021. Just under a quarter of the total transaction volume transacted with retail properties in Germany was recently attributable to retail parks (see chart "Transaction volume of retail properties in Germany"). No other retail property format attracted more money. However, this booming segment is also facing new challenges.

The relative increase in the importance of retail parks is offset by an absolute decline in volume. In spring, the annual transaction volume fell below the two billion euro mark for the first time in four years. A shortage of properties for sale is one of the reasons for this development. For a long time, buyers of specialist store centers have been characterized by a long holding period, and in this respect, supply is undoubtedly tighter than it was a few years ago.

Conversely, demand for retail parks, which promise stable rental income in the long term, is undiminished and consequently so are prices. This is particularly true in comparison with other European countries. While prime yields in this country are below four percent, they are at least five percent in France, Great Britain and Spain. In other countries, they are even higher. In view of this price difference, some cross-border investors limit their search for suitable retail parks to other European countries - this is another reason for the declining transaction volume. Success factor local supply But it is not only the high prices that are causing some investors to hesitate. The pandemic and its consequences have also left their mark, of course. Investors have become more cautious, especially about properties with a perceived risky textile stock. Even more so than before the pandemic, the stock of retail parks is thus splitting into two parts: On the one hand, there are those centers to which investors attribute the ability to generate sustainably stable rental income. On the other side are those that do not enjoy this investor confidence. The category in which investors place a retail park depends to a large extent on one characteristic: the share of local retail in total earnings.

But it's not just the high prices that are causing some investors to hesitate. Of course, the pandemic and its consequences have also left their mark. Investors have become more reluctant, especially when it comes to objects that have a supposedly risky textile trimming. Even more so than before the pandemic, the inventory of retail parks is divided into two parts: on the one hand, there are those centers that investors believe are able to generate stable rental income over the long term. On the other hand, there are those who do not enjoy this level of investor confidence. The category in which investors sort a retail park depends very much on one characteristic: the share of local supply trade in the total income.

Since the start of the pandemic, we have been observing an e-food boom in this country, which will leave further traces as technological progress continues, especially for standard convenience items such as milk or canned goods. It won't be long before these items order themselves via algorithms when a household needs them. With a slight time lag, developments such as those that have already taken place in other areas of the retail sector may also emerge in the local supply segment.

This process has now picked up speed with players like Flink and Gorillas. It is not yet possible to estimate the pace at which it will continue. However, it is safe to say that it will have an impact on food retailing and therefore on retail parks. For the time being, the expansion of food delivery services will tend to affect retail parks in the major conurbations. However, these locations are clearly in the majority, and thus a significant proportion of all properties here are already located within a delivery area of at least one e-food provider (see map).

"Since the onset of the pandemic, we've seen an e-food boom in this country that will continue to leave its mark as technology advances, especially in standard convenience items such as milk and canned goods." E-food as an opportunity.

E-Food as a chance

The formula "the more local supply, the better" therefore falls somewhat short as an investment strategy. For retail parks outside the conurbations, it will probably remain valid for a long time to come. In all other cases, determining the intensity of competition in local food retailing, taking e-food providers into account, will certainly become essential for the overall assessment of a retail park. After all, food delivery services will be an integral part of our cities of the future. However, considering them as additional competition for stationary food retailing in retail parks and elsewhere is only one side of the coin.

The fact that these same players are also potential users for space in retail parks is the other. This is because e-food suppliers are in principle involved in the same supply chains as their traditional counterparts, and to that extent their location requirements overlap at least in part. Moreover, their demands on space are low, at least for the last links in the supply chain.

We therefore expect retail parks which can no longer be fully occupied by retail space, but which, given the right location quality, have repositioning opportunities in the direction of a "mixed use" with retail, logistics and commercial space. Opportunities are arising in the logistics segment in particular. The cities of the future will most likely accommodate much less retail space than today, but much more logistics space. Today, in addition to traditional logistics, there are already attractive self-storage concepts and concepts that offer production companies in a region both production and workshop space as well as modern office space under a hall roof as part of a retail park. We will see more of this in the future.

By Jörg Krechky, Savills